Greek employers report cautiously optimistic hiring climate for the January to March time frame.

-

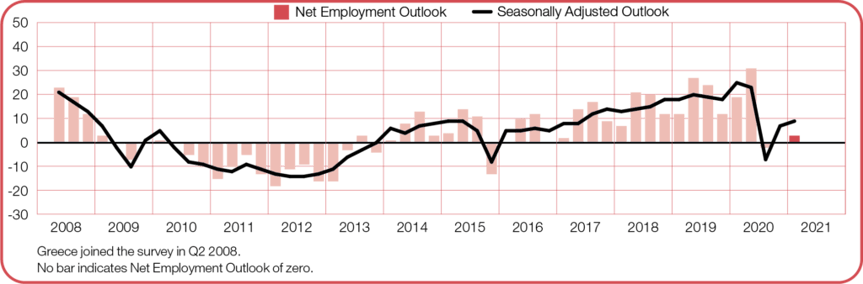

Net Employment Outlook1 for Q1 2021 stands at +9%. Hiring prospects improve by 2 percentage points when compared with the previous quarter but decline by 16 percentage points in comparison with last year at this time.

-

39% of Greek employers expect that will return to pre-COVID-19 hiring levels in the next 12 months.

- The strongest hiring pace is forecast for the Manufacturing sector where the Net Employment Outlook stands at +19%. Construction sector employers also report respectable hiring plans with an Outlook of +12%, while Outlooks of +11% are reported in two sectors – the Finance & Business Services sector and the Other Production2 sector. Elsewhere, Other Services3 sector employers anticipate modest job gains with an Outlook of +7%, while Outlooks of +2% and +1% are reported for the Wholesale & Retail Trade sector and the Restaurants & Hotels sector, respectively.

Athens (December 8, 2020)

According to the ManpowerGroup Employment Outlook Survey4 released today, 430 Greek employers report cautiously optimistic hiring climate for the January to March time frame. With 14% of employers anticipating an increase in payrolls, 11% expecting a decrease and 74% forecasting no change, the resulting Net Employment Outlook (NEO) is +3%. Hiring prospects improve by 2 percentage points when compared with the previous quarter, but decline by 16 percentage points in comparison with last year at this time. 39% of Greek employers expect that will return to pre-COVID-19 hiring levels in the next 12 months, while globally this percentage stands at 41%. From the Greek employers who forecast a return to pre-COVID-19 hiring levels in the next 12 months, the strongest pace is stated from those coming from Restaurants & Hotels (58%), Construction (44%) and Other Production (40%) sectors.

“Facing the second sweeping wave of the COVID-19, the forecast survey on the employment outlook for the first quarter of 2021 shows encouraging data for the Greek market, highlighting our country as the strongest in hiring intentions throughout the wider EMEA region. It is worth noting that for the industries that coped with the first lockdown such as Construction and Manufacturing as well as Finance and Business services, the employment outlook seems stronger. In the tourism sector, the situation remains volatile, although employment prospects are slightly positive. The challenges of managing our people such as upgrading their skills, choosing the right mix of strategic workforce management, selecting and recruitment tech talents for the needs of digital transformation we have all been called upon to accomplish, are more critical than ever and require our attention,” stated Charalambos Kazantzidis, CEO of ManpowerGroup Greece.

Historical Net Employment Outlook Trend for Greece

Sector Comparisons

Employers expect to increase payrolls in all seven industry sectors during the upcoming quarter. The strongest hiring pace is forecast for the Manufacturing sector where the Net Employment Outlook stands at +19%. Construction sector employers also report respectable hiring plans with an Outlook of +12%, while Outlooks of +11% are reported in two sectors – the Finance & Business Services sector and the Other Production sector. Elsewhere, Other Services sector employers anticipate modest job gains with an Outlook of +7%, while Outlooks of +2% and +1% are reported for the Wholesale & Retail Trade sector and the Restaurants & Hotels sector, respectively.

Strongest & Weakest hiring intentions

|

Manufacturing |

Construction |

Finance & Business Services |

|

19% |

12% |

11% |

|

Restaurants & Hotels |

Wholesale Retail & Trade |

Other Services |

|

1% |

2% |

7% |

Organization-Size Comparisons5

Workforce gains are anticipated in three of the four organization size categories during the coming quarter. The strongest labor market is forecast by Large employers with a healthy Net Employment Outlook of +24%. Elsewhere, Outlooks of +11% and +8% are reported for the Medium- and Small-size categories, respectively, but Micro employers anticipate an uncertain hiring climate with an Outlook of -1%. Hiring sentiment weakens in all four organization size categories when compared with this time one year ago, with Micro firms reporting the most noteworthy decline of 18 percentage points. Outlooks decrease by 16 percentage points for Small- and Medium-size employers, while Large employers report a decline of 13 percentage points.

International comparisons

Employers in 34 of the 43 countries and territories surveyed by ManpowerGroup employers expect to add to payrolls during the first quarter of 2021. Employers expect to trim payrolls in seven countries and territories during the coming quarter, while flat labor markets are forecast in two.

Hiring sentiment strengthens in 32 countries and territories when compared with the previous quarter, while declining in six and remaining unchanged in five. In a comparison with this time one year ago, employers in 33 countries and territories report weaker hiring intentions, while Outlooks strengthen in six and are unchanged in four. During the next three months, employers anticipate the strongest hiring activity in Taiwan, the U.S., Singapore, Australia and Brazil. The weakest labor markets are expected in Panama, the UK, Switzerland, Austria and Hong Kong.

Employers expect to add to payrolls in 19 of the 26 Europe, Middle East & Africa (EMEA) region countries during the upcoming quarter, while a decline in payrolls is anticipated in five and flat hiring activity in two. Hiring prospects improve in 18 EMEA countries in comparison with the prior quarter, but weaken in 24 countries when compared with last year at this time. The strongest hiring plans for the next three months are reported in Greece, Germany and Turkey, while employers in the UK, Switzerland and Austria anticipate the weakest labor markets.

The next ManpowerGroup Employment Outlook Survey will be released on 9th March 2021 and will detail expected labor market activity for the second quarter of 2021.

*Commentary is based on seasonally adjusted data where available. Data is not seasonally adjusted for Croatia or Portugal.

[1] The Net Employment Outlook is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting a decrease in hiring activity. Commentary is based on seasonally adjusted data.

[2] Other Production includes Mining & Quarrying, Agriculture, Hunting, Forestry & Fishing, Electricity, Gas & Water sectors.

[3] Other Services includes Public & Social, Transport, Storage & Communication sectors.

[4] ManpowerGroup interviewed globally 37,717 employers in 44 countries and territories to forecast labor market activity in the third quarter of 2020. All participants were asked, “How do you anticipate total employment at your location to change in the three months to the end of March 2020 as compared to the current quarter?”

[5] Participating employers are categorized into one of four organization sizes: Micro businesses have less than 10 employees; Small businesses have 10-49 employees; Medium businesses have 50-249 employees; and Large businesses have 250 or more employees.

You can read the infographic with the survey results here.

In case you would like to receive the detailed survey report, you may contact the Communications Department ManpowerGroup Greece. vtsouni@manpowergroup.gr, ekaragiannis@manpowergroup.gr.